China Market Research and Entry Preparation for a Nordic Outdoor Clothing Brand

A Nordic brand developing and selling outdoor apparel was looking to enter the fast-growing Chinese e-commerce market. ARC Consulting conducted an in-depth research of the Chinese outdoor clothing market with focus on e-commerce, and then studied the practicalities and costs associated with opening an legal entity and setting up an efficient market presence, including trademark registration, platform registration, logistics, warehousing and much more.

The research resulted in a detailed action plan with estimated budget for the endeavor and an investment schedule.

The client, a Nordic outdoor clothing company, had with great success been using European social media for brand marketing. The Chinese market and its online landscape was, however, uncharted territory for the client. The competition, the e-commerce channels, the social media platforms and the complexity of legal setups were all different in China compared to Western markets.

The client hired ARC Consulting to conduct a customized market research project according to the client’s needs. The main aim was to understand the Chinese outdoor clothing market better in terms of stakeholders, entry mode, market segments, preferred e-commerce channels, target customer groups and pricing strategy.

The project started by setting up a kick-off meeting between ARC Consulting´s team and the client in order to determine the time plan, focus areas and expected outcome of the project. During the process of the project, ARC Consulting held bi-weekly project reviews with the client in order to ensure that all communication was timely and that the deliverables were meeting the client’s specific needs and expectations.

The project team gathered necessary data by two ways:

- Desktop research on various e-commerce platform websites, sales databases, governmental websites, and secondary industry reports;

- Interviews with related stakeholders such as major platforms, industry experts, public officials, registration agencies and potential customers.

The collected data was then analyzed and summarized in a report covering the following parts:

- Outdoor clothing market overview including market trends and segmentation;

- Sales channel review, in particular Chinese E-commerce platform evaluations including comparison and analysis of entry requirements, advantages and disadvantages of major platforms and recommendations;

- Benchmarking major competitors in terms of sales channels, marketing channels and pricing on the Chinese market;

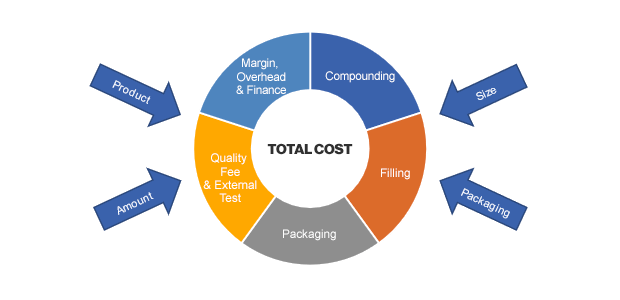

- Cost build-up analysis of both fixed and variable costs in order to determine the optimal pricing strategy in China;

- Administrative process, required timeline and costs of platform registration, legal entity setup, trademark registration, logistics & warehousing, office & operation.

ARC Consulting offered recommendations on pricing strategy and target customer groups. In addition, the team suggested the client to utilize JD.com and Tmall as primary domestic sales platforms due to their high market share and customer reach in China for the client´s business. The consultants also suggested utilizing the logistics and warehousing service integrated by the platforms at the beginning in order to lower fixed costs until sales volumes had increased.

Besides platform registration and logistics setup, the team made a detailed action plan about legal entity registration in both Hong Kong and Shanghai, trademark registration, local staffing, and office rent. Considering the associated costs in each action, the consultants made an investment schedule to help the client visualize the cash flow required for a successful market entry.

Based on the provided information in the market research report and the step-by-step action plan, the client decided to follow the outlined recommendations by ARC Consulting.

The client immediately started the implementation phase of trademark registration and legal entity setup in order to be able to complete the registration process at e-commerce platforms JD.com and Tmall, and launch sales on the Chinese market as soon as possible.

See more about our market entry consulting services and our experience in the consumer products sector.