Vietnam Economic Update Report

Quarter 1, 2023

In this issue:

Vietnam’s GDP inched up by 3.32% year-on-year in the first quarter of 2023

2023’s first quarter growth of 3.32% year-on-year (YoY) is the second to worst recorded first quarter growth since 2011, only beating the 3.21% growth in Q1 2020.

The GDP growth of 3.32% in the first quarter of 2023 is a dramatic fall from the 5.92% growth of the previous quarter and 5.03% the same period of the previous year. According to the Director of the General Statistics Office of Vietnam (GSO), the economic expansion rate of 3.32% was primarily impacted by ongoing turbulence in the world economy, including prolonged high global inflation and weakening demand from major trading partners.

The industrial and construction industries in Vietnam, which are two of the primary drivers of the national economy, saw a collapse during the quarter, due to high input costs along with a dramatic drop in the number of orders. Specifically, the industrial and construction sector slipped by 0.4% in the Q1 of this year, causing -4.76% drop to the overall growth.

In contrast, the agro-forestry-fishery sector and the service sector rose by 2.52% and 6.79% YoY respectively, contributing 8.85% and 95.91% to the overall expansion. In the same quarter, the total retail sales of consumer products & services increased by 13.9% YoY.

Despite mounting external pressures, Vietnam planned to maintain its annual economic growth target of 6.5% for 2023.

Vietnam’s exports and imports dropped in Q1 of 2023

In the January-March period of 2023, Vietnam's total import-export turnover of goods reached 154.27 billion USD, shrinking by 13.3% compared to the same period last year.

Specifically, exports nosedived by 11.9% to 79.17 billion USD, while imports plummeted by 14.7% to 75.1 billion USD. This translated into a trade surplus of 4.07 billion USD.

As most major export markets were contracting, trade issues persisted. For example, 40% of manufacturing and processing firms experienced a decline in export orders in Q1 2023 compared to the same quarter last year amid weakening global demand. Specifically, smartphones and electronics, two of Vietnam’s largest export contributors, fell sharply by 15% and 10.9% YoY respectively. Besides, exports to important markets such as the US, China, and the EU plunged by 21.1%, 12.6%, and 8.1% YoY respectively.

During the first three months of 2023, the US continued to be the largest importer of Vietnam with an estimated turnover of 20.6 billion USD, while China remained Vietnam’s largest supplier with an estimated turnover of 23.6 billion USD.

Vietnam’s industrial production index suffered a fall

During the first quarter of 2023, Vietnam’s index of industrial production (IIP) sank by 2.2% compared to the same period a year ago. This fall was caused by influences of the world economy’s issues on domestic production and business, according to the General Statistics Office of Vietnam (GSO).

During Q1 2023, most sectors suffered a fall in IIP. Only a minority of industries experienced a rise, such as water supply, sewerage, waste management and remediation activities which saw an increase of 7.8%. The mining industry experienced the deepest decline with an IIP decrease of 4.4%. Following was a decline of 2.4% in the processing and manufacturing industry, while the electricity generation and distribution sector saw a loss of 1%.

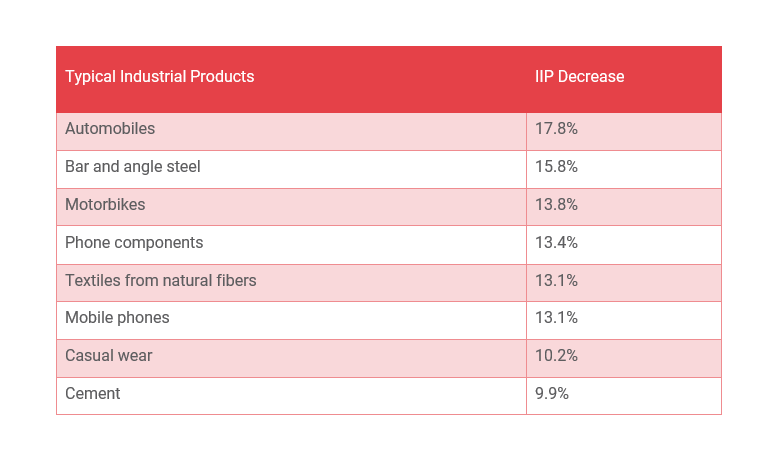

When zooming in, several industrial products underwent a nosedive in IIP in this quarter as illustrated in the table below.

GSO’s data also showed that IIP in this quarter climbed in 48 localities but dived in 15 localities. Plenty of localities achieved a relatively high increase in IIP for the January-March period of 2023 primarily thanks to the increase of IIP in the processing & manufacturing industry and the electricity generation & distribution industry. In contrast, other localities witnessed a fall in IIP.

One contributing factor was the Russia-Ukraine war that has contributed to increased commodity prices for input fuel, energy, and logistics, negatively exerting an impact on domestic businesses’ production costs. In addition, while the domestic market saw a resumption in purchasing power, the domestic recovery was still too inert to stimulate production. In parallel, China’s reopening placed an enormous strain on nations like Vietnam that sell similar goods as China’s, escalating economic rivalry.

Moreover, tighter monetary policies were deployed globally in reaction to the rising inflation. As a result, some significant consumer markets, including the US and EU, started restricting spending, dampening demand for goods as a by-product. Indirectly, this led to a decline in export orders, which had adverse effects on Vietnam’s production.

Nevertheless, the GSO reported that the majority of surveyed businesses gave favorable assessments of the production and business situation in Q1 2023, with 61.5% of businesses stating that the situation was stable or better than it was in the last quarter of 2022. The outlook of Vietnamese businesses for the next quarter followed a similar optimistic pattern, with 44.1% of businesses anticipating that the production and business environment will be stable or better than it has been in the first quarter.

The industrial production outlook may be brighter in upcoming quarters as the GSO suggested many directions for the state, ministries, and local governments to assist enterprises in overcoming production challenges. Priority will be given to improving trade promotion operations, seeking and expanding export markets, providing tax breaks, and promoting domestic demand.

Vietnam’s Central Bank cuts rates to push economic growth

The State Bank of Vietnam (SBV) has lowered its policy interest rate for the first time since October 2020 in an effort to stabilize the financial system and promote economic expansion. More specifically, various policy rates have been slashed by 50-100 basis points under Decision No 313/Q-NHNN.

Accordingly, the annual rediscount interest rate was cut by one percentage point starting March 15 this year. The same 1% cut would be applied to the overnight electronic interbank rate and the interest rate for loans to offset capital shortages in clearance between the central bank and commercial banks. In addition, to satisfy the capital requirements of the Government’s prioritized industries, the SBV also reduced the maximum short-term interest rate of VND-denominated loans from 5.5% to 5% per year. This cut, notably, improves the ability of businesses and individuals in industries to obtain loans at more affordable rates.

The SBV’s contrasts central banks all over the world as most are tightening monetary policies and raising, or maintaining, interest rates at high levels. The SBV believes that cutting interest rates in line with the market’s current circumstances is a flexible strategy for achieving the government’s goal of economic recovery as it lowers market interest rates, removing barriers for businesses and individuals. However, the SBV declared that it would maintain vigilant, focusing on signals from the FED’s upcoming policies in the wake of the demise of tech-focused lender Silicon Valley Bank.

In 2023, Vietnam intends to keep inflation below 4.5%.

About this report

This report was compiled with contributions from the team of business experts in our Vietnam office.

ARC Consulting, a division of ARC Group, is an advisory firm specialised in supporting western companies operating in Asia. We are on a mission is to bridge between the business ecosystems of Asia and those in Europe and the US. Our services cover market entry and expansion, production and sourcing, cross-border M&A as well as operational improvement and compliance.

If you are interested in exploring how we can support your business in Vietnam, reach out through our contact page, or leave your email below for a representative to contact you directly: