Indonesia Economic Update Report

Quarter 1, 2023

In this issue:

Indonesia’s GDP growth reaches 5.03% in the 1st quarter of 2023, exceeding expectations

Fueled by domestic consumption and a positive trade balance, Indonesia’s GDP has maintained a strong performance with a 5.03% YoY growth. For 2023, the Bank of Indonesia is targeting the economic growth to reach between 4.5% to 5.3%.

During the first quarter of 2023, the country’s economic growth was maintained above the level of 5% as it reached 5.03% (YoY), beating the previous quarter’s 5.01% result. In fact, the country’s economic growth in this period was considered one of the highest globally. Amid the global economic slowdown, the country managed to maintain a strong performance through its resiliency. The economy was supported by a strong household consumption, which contribution 2.44% to the total GDP, followed by international trade contributing 1.69%, investment with 0.68%, and other factors with 0.22%. Inflation experienced a downward trend at 4.97% by March 2023, a steep decline from 5.51% in December 2022.

The major industries, such as manufacturing (0.92%), trade (0.64%), transportation and warehouse (0.64%), and information and telecommunication (0.46%) also contributed strongly to the economic growth. All industries grew positively in the 1st quarter. However, the transportation and warehouse sector experienced the highest growth by 15.93% (YoY), in line with the increasing mobility of society. The Bank of Indonesia has projected that the economic growth will remain strong driven mainly by domestic demand.

A steady positive trade balance contributes to 1st quarter’s result

Fueled by domestic consumption and a positive trade balance, Indonesia’s GDP has maintained a strong performance with a 5.03% YoY growth. For 2023, the Bank of Indonesia is targeting the economic growth to reach between 4.5% to 5.3%.

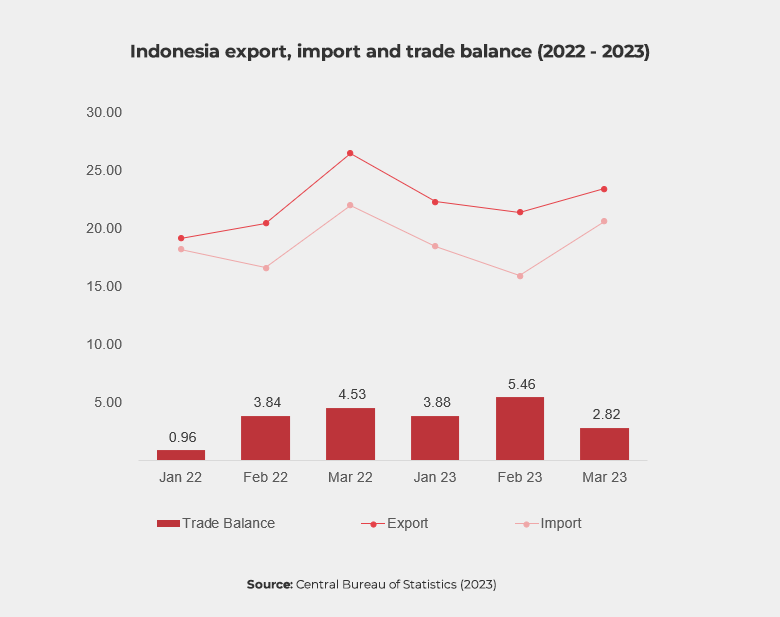

Despite of the falling commodity prices and gloomy global economic projection, the country has been able to maintain a positive trade balance, a continuing trend since May 2020. During the first quarter of 2023, there was a surplus of USD 12.25 billion, a growth of 31.3% in comparison to the same period in 2022.

Within this period, the increase in exports was mainly due to persistently high global demand for non-oil and gas commodities, such as mineral fuels, vegetable animal fats and oils, steel, and nickel. Ensuing the trend from 2022, Indonesia benefitted the most from its trade surplus with the US, India, and the Philippines. Surprisingly, for March exports to Switzerland, Russia, Italy, Belgium, and Spain rose by more than 40%.

The construction of Nusantara - Indonesia's new capital city

The idea to develop a new capital city, namely Nusantara, was first mentioned by the 1st president of Indonesia, Soekarno, in 1957. However, the development has just been realized 7 decades later by the 7th president, Joko Widodo (Jokowi). It’s expected that the development of New Capital City will encourage development and drive the economy in eastern Indonesia.

There are several reasons to why the government of Indonesia decided to relocate the capital to the new location in the province of East Kalimantan. Few of those include (1) population (approximately 57 percent of Indonesia’s population is concentrated on the island of Java with the largest economic contribution to the GDP, equal to 59%); (2) water supply crisis on the Java Island, especially in Jakarta; (3) the high urbanization growth in Jakarta, causing high congestion and unhealthy air quality; and (4) a highly-concerned environmental aspects as the decrease of Jakarta’s groundwater level reaches 7.5-10 cm/year, a heavily-polluted water quality, and high-degree of pollution. Despite this, Jakarta is still planning to become the world’s largest city in the future.

Although the development of the New Capital City was formerly decided in 2019, the development of this city is still causing controversy. The urgency to move forward with the capital city has been questioned. Few experts argue that developing the planned area of the new IKN (256,142 Ha) won’t be an easy task. Regardless, the government is still going forward with the development as the House Representative also approved the plan with unanimous vote in 2019.

The construction of the New Capital City is expected to take 18-20 years, with a total required investment of USD 34 billion. 80% of the financing scheme is expected to come from private investment (a government-to-business cooperation scheme and a joint private sector and a state-owned business direct scheme) and the remaining 20% is covered by the state budget. Several incentives have also been introduced by the government to attract foreign investments.

Presently, some international organizations and governments, such as: USAID, Finnish Government, Hyundai, ADB, the Government of Netherlands, WWF, and Clean Air Asia have already committed their involvements in the design of 8 planned clusters within the new city. Approximately 167 potential investors from 16 countries have shown interests in investing in the New Capital City.

Until March 2023, the Ministry of Public Works and Housing has signed 30 contracts, mostly with state-owned construction companies, to develop infrastructure, government offices and housing construction projects worth USD 1.6 billion. The goal is to complete 47 apartment towers in 2023. By 2024, an initial 5,000 residents (public servants and families) are planned to reside in the new capital.

The development of the new capital and latest investment trends toward the eastern part of country will undoubtedly transform this neglected area to be a new center for the country’s economy. As the economy in the area grows, more businesses and investments are likely to pour to the area.

The struggles of Indonesia's start-up industry

Just as the economic reopened from lockdown, the macroeconomic situation hit the start-up industry in Indonesia. Following the recent shakedown of the global tech industry, such as Facebook, Twitter, Dropbox and Shopify, similar companies in Indonesia have also experienced the same trend. Between November 2022 and April 2023, around 30 Indonesian tech companies laid off more than 3,000 staffs.

The trend has affected both start-up companies as well as the industry unicorns, such as: GoTo, Traveloka, Bukalapak, and Shipper. Elevenia, which was a subsidiary of Salim Group (a conglomerate group with businesses ranging from instant noodle, car manufacturing, convenience store to flour milling), also closed its services in December 2022. The global challenges and intense competition in the e-commerce sector are few reasons to why these companies streamline their operations.

The Gross Merchandise Value (GMV) is a major point in assessing the potential profitability of any start-up. However, investors are putting more focus on businesses sustainability nowadays. Revenue and profitability are key points for venture investments to assess start-up companies. As such, business remodeling and positive cashflow management are highly required for start-up companies to get their business sustainable in a long run. Start-ups’ burning money strategy will likely reduce as profit is more important than significant market shares. This new development is expected to attract more global investors since feasible business cases can be expected from these start-ups soon.

About this report

This report was compiled with contributions from the team of business experts in our Indonesia office.

ARC Consulting, a division of ARC Group, is an advisory firm specialised in supporting western companies operating in Asia. We are on a mission is to bridge between the business ecosystems of Asia and those in Europe and the US. Our services cover market entry and expansion, production and sourcing, cross-border M&A as well as operational improvement and compliance.

If you are interested in exploring how we can support your business in Indonesia, reach out through our contact page, or leave your email below for a representative to contact you directly: