Investment

Outlook

Vietnam - 2023

In this issue:

Vietnam’s investment landscape

Vietnam has continued to be an attractive destination for foreign investments. The country’s investor-friendly policies and strong economic growth in an otherwise bleak worldwide economic condition proved to be effective magnets for foreign investors. With China’s reopening coupled with a new strategy to attract high-value investments, 2023 seems to promise an even more successful year.

Economic growth

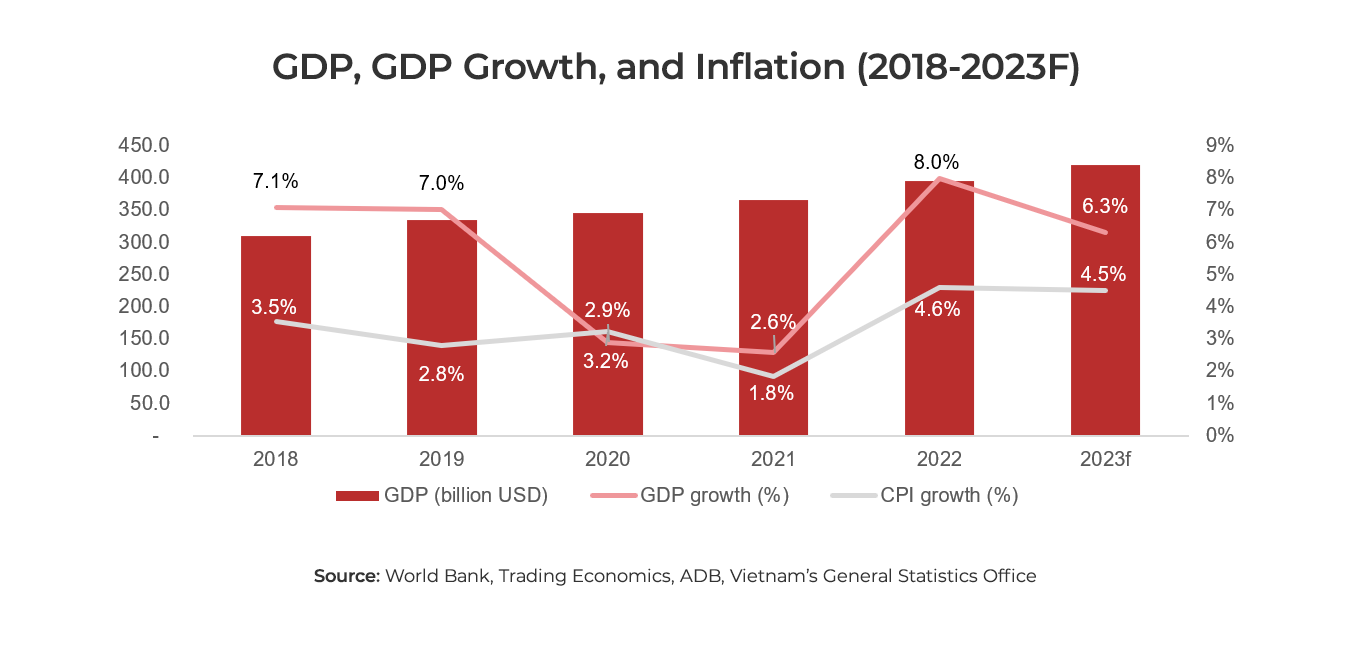

Vietnam defied geopolitical instability and a turbulent global economy in 2022 to score a remarkable 8% year-on-year (YoY) GDP growth rate, the highest in 11 years. This impressive figure can be attributed to strong domestic demands and a 10.5% YoY growth in exports. Although GDP growth averaged only 5.5% in Q1 and Q4/2022, an impressive 13.7% rise was recorded in Q3/2022 which helped propel the overall growth of Vietnam’s economy in 2022. The high growth in the quarter was largely due to rising government infrastructure spendings and high retail sales.

Nevertheless, Vietnam’s rapid economic growth might decelerate in 2023. The Asian Development Bank (ADB) predicts that the economy will only show a 6.3% growth, while the National Assembly projects a 6.5% rate. The lowered expectation is cause by the anticipated weakening of global demand, affecting Vietnamese exports, and a slowdown in the disbursement of public investments. However, China’s reopening and the resulting rise in demand are expected to offset parts of those factors and provide boost to the economy.

Inflation

Vietnam’s Consumer Price Index (CPI) grew by 4.6% YoY in 2022, the highest since 2019. The sectors that saw the highest rise in CPI include education at 11.8%, construction materials at 7.1%, and food products at 5.2%.

To help increase the disbursement of public investment in 2023, the National Assembly has set a higher ceiling for CPI growth at 4.5% YoY. Despite the higher target, there are worries that global fuel prices remain an unpredictable factor that may push inflation beyond the 4.5% threshold.

Foreign direct investment (FDI)

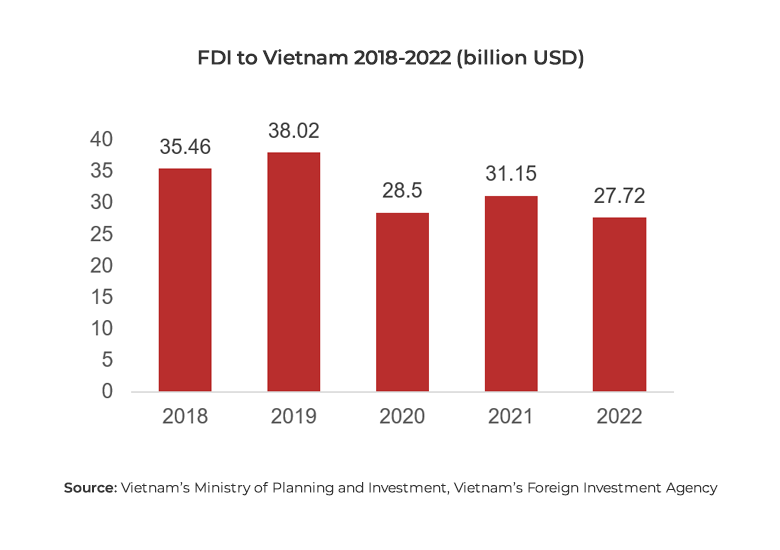

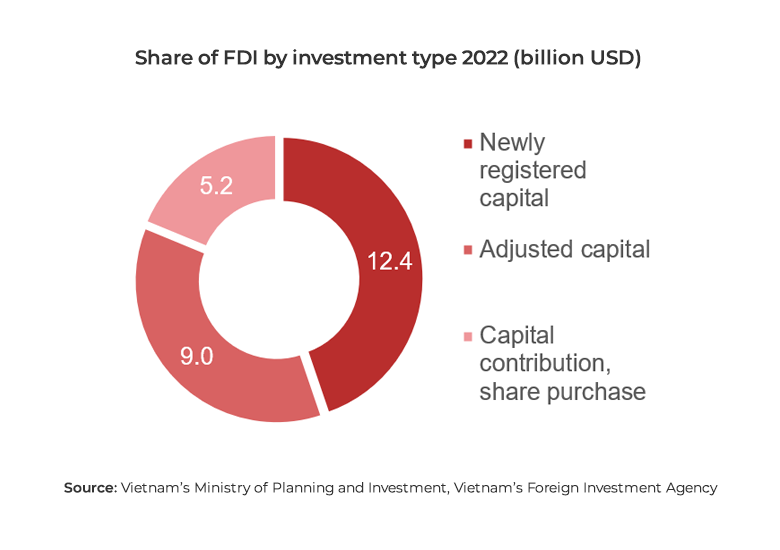

According to the Foreign Investment Agency (FIA) of the Ministry of Investment and Planning, Vietnam’s 2022 inbound FDI reached a value of US$ 27.72 billion, or 89% of the 2021 figure. The slight reduction in FDI was caused by rising interest rates and weakening global demand. Despite this reduction, the disbursement of FDI in 2022 was US$ 22.4 billion, the highest in the past five years. The high disbursement rate was the result of additional capital injection of existing projects from previous years.

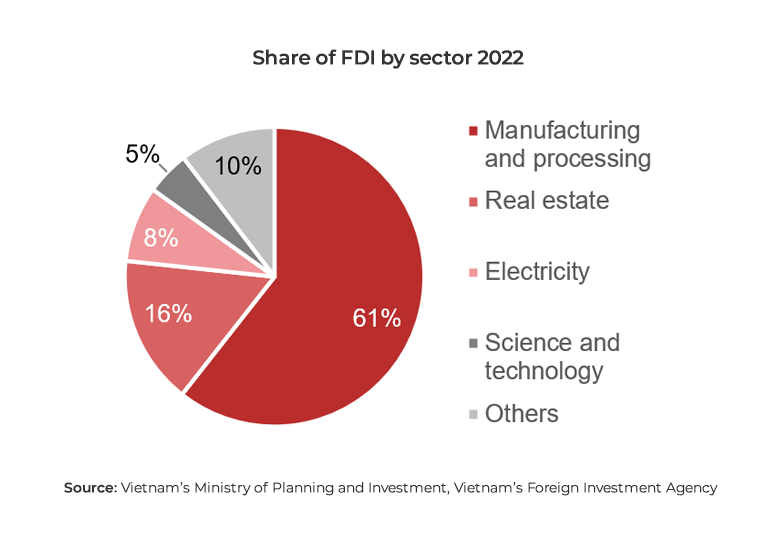

Singapore remained the largest foreign investor in Vietnam, out of 108 countries and territories, with US$ 6.5 billion, or 23.3% of the total foreign investments. The manufacturing sector continued to be the largest magnet of foreign investments with US$ 16.8 billion, or 60.6% of the total registered investments.

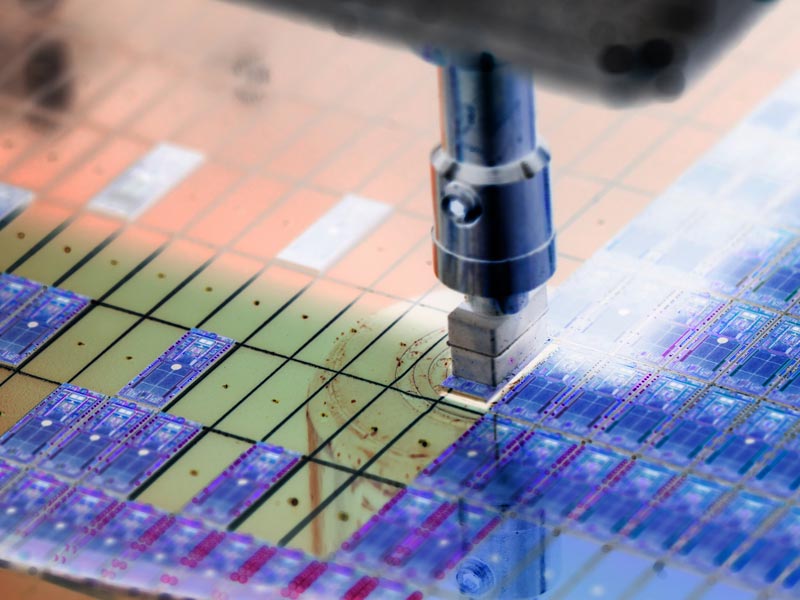

Despite a relatively moderate performance in 2022, FIA optimistically predicts that FDI into Vietnam will reach US$ 36-38 billion in 2023. This is in large thanks to China’s reopening and the consequent flow of Chinese capital, which was previously hampered by the country’s COVID restrictions. The electrical and electronics manufacturing sector is expected to be the largest benefactor of FDI as global technology giants such as Samsung, LG, and Foxconn continue to diversify their production lines in Vietnam.

Vietnam’s new strategy on foreign investment

In 2022, the Vietnamese Government issued a new strategy for foreign investment cooperation for the next eight years. The goal of the strategy is to attract high-tech and high-value foreign investments and help advance Vietnam’s technological capabilities.

With the ambition to improve both the quantity and quality of foreign investments in Vietnam, especially in the technology sector, the Vietnamese Government issued Decision 667/QĐ-TTg in June 2022. The Decision outlines a new strategy for foreign investments between 2021 and 2030 and include the following provisions:

- Create a more transparent, open, and fair business environment with more robust legal frameworks for resolving disputes.

- Create and develop science and technology ecosystems with flexible management systems to help facilitate technological innovations.

- Improve and complete the digitalization of the government to increase efficiency of public administration.

- Improve the skills and expertise of the labor force, especially in technological skills.

- Improve the legal frameworks for protecting intellectual property (IP) rights to help boost innovation.

- Improve communication channels between investors and government organs to quickly resolve investors’ problems.

- Encourage technology transfer through the commercialization of technological innovations and joint ventures between foreign-invested enterprises with Vietnamese ones.

- Increase linkages between foreign-invested companies and Vietnam’s universities and research institutions.

Overall, the strategy seeks to create a more conducive policy environment for foreign investors by improving Vietnam’s public administration, workforce, and business environment. Furthermore, the strategy also aims to address existing weaknesses, such as the country’s lax IP regulations, in order to help protect the technological innovations of foreign-invested enterprises.

In the long run, the strategy is aiming to enable Vietnam to become one of the top three Southeast Asian countries, and top 60 in the world, in ease of doing business. With the strategy, Vietnam is hoping to increase inbound FDI by nearly three times, from US$ 27.7 billion in 2022, to about US$ 80 billion in 2023, and increase the number of Fortune 500 companies that invest in the country by 50%, all by 2030.

Vietnam to attract more FDI in green energy in 2023

In 2022, Vietnam witnessed some significant external and internal developments on green energy. These developments, in turn, point to a bright prospect of green energy for foreign investors seeking opportunities to invest in 2023 and beyond.

In December 2022, Vietnam and the International Partners Group (IPG), which includes the European Union, the United Kingdom, the United States, and Japan agreed to a Just Energy Transition Partnership (JETP) agreement. Through the agreement, the IPG, together, with ADB and the World Bank, pledged US$ 7.75 billion with the purpose to help Vietnam achieve net zero emissions by 2050. With the contribution, Vietnam became the third country in the world, after South Africa and Indonesia, to receive support through the JETP program. In addition to the pledge from international organizations, Vietnam is also expected to receive a matching investment from private financial institutions such as Bank of America, Citibank, Deutsche Bank, and HSBC.

Beyond financial support, Vietnam will also receive technical assistance from the United Nations Development Programme (UNDP). UNDP is currently assessing the impact of phasing out coal power and measuring the effects of energy transition in Vietnam. The organization is also working with local governments to support initiatives such as ecotourism. With the infusion of funds from the JETP program, UNDP expects to scale up these existing efforts to also include promoting a transition to green transportation.

Coupled with international assistance, the Vietnamese government has also demonstrated their determination to achieve the ambitious goal of attaining net zero by 2050 by redrafting the entire Power Plan VIII, a strategic energy plan. In the redraft, the country has decided to embark on a bolder vision and intends to stop construction of new coal-fired power plants by 2030. The initiative is considered quite drastic considering the current importance coal has in the country’s energy composition. Furthermore, to make up for any potential shortfalls that cancelling four coal power projects might cause, the new plan also promotes the development of other green energy sources such as wind and solar. Some measures that are aimed at attracting foreign investors into the green energy sector include reforming the price policy to ensure profitability for investors, allowing the direct sales of electricity, and instituting a more transparent bidding process.

These developments demonstrate the rising prominence of green energy in both Vietnam’s national planning and international development efforts. The confluence of these factors has made the sector increasingly attractive to foreign investors as an area of growth and green energy is becoming a key factor in Vietnam’s journey to realizing its ambitious climate goals.

About this report

This report was compiled with contributions from the team of business experts in our Vietnam office.

ARC Consulting, a division of ARC Group, is an advisory firm specialised in supporting western companies operating in Asia. We are on a mission is to bridge between the business ecosystems of Asia and those in Europe and the US. Our services cover market entry and expansion, production and sourcing, cross-border M&A as well as operational improvement and compliance.

If you are interested in exploring how we can support your business in Vietnam, reach out through our contact page, or leave your email below for a representative to contact you directly: