Investment

Outlook

Indonesia - 2023

In this issue:

Indonesia’s investment landscape

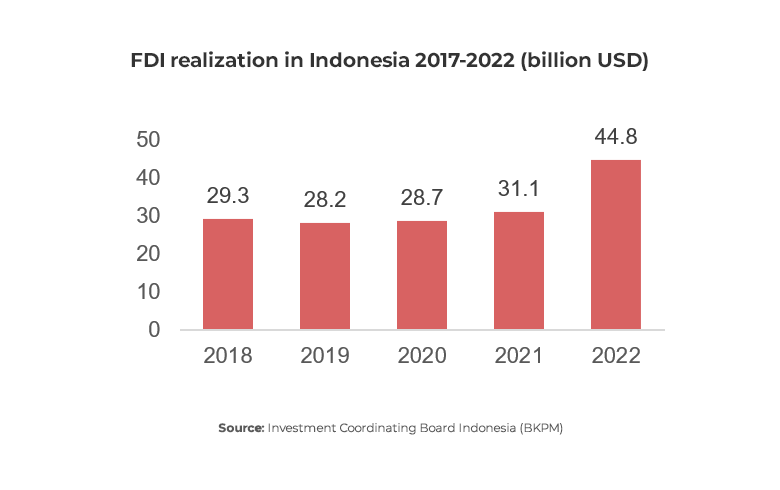

With its natural resources, stable economy, and favorable demography, Indonesia serves as an attractive destination for investment and has continued to receive more attention as a strategic destination to invest in. By the end of 2022, the growth in FDI realization continued with a YoY growth of 44.2%. The strong interest is expected to continue in 2023 as the government has targeted the total investment to reach US$ 96.46 billion, an increase of 16.7% from the target in 2022.

Economic growth

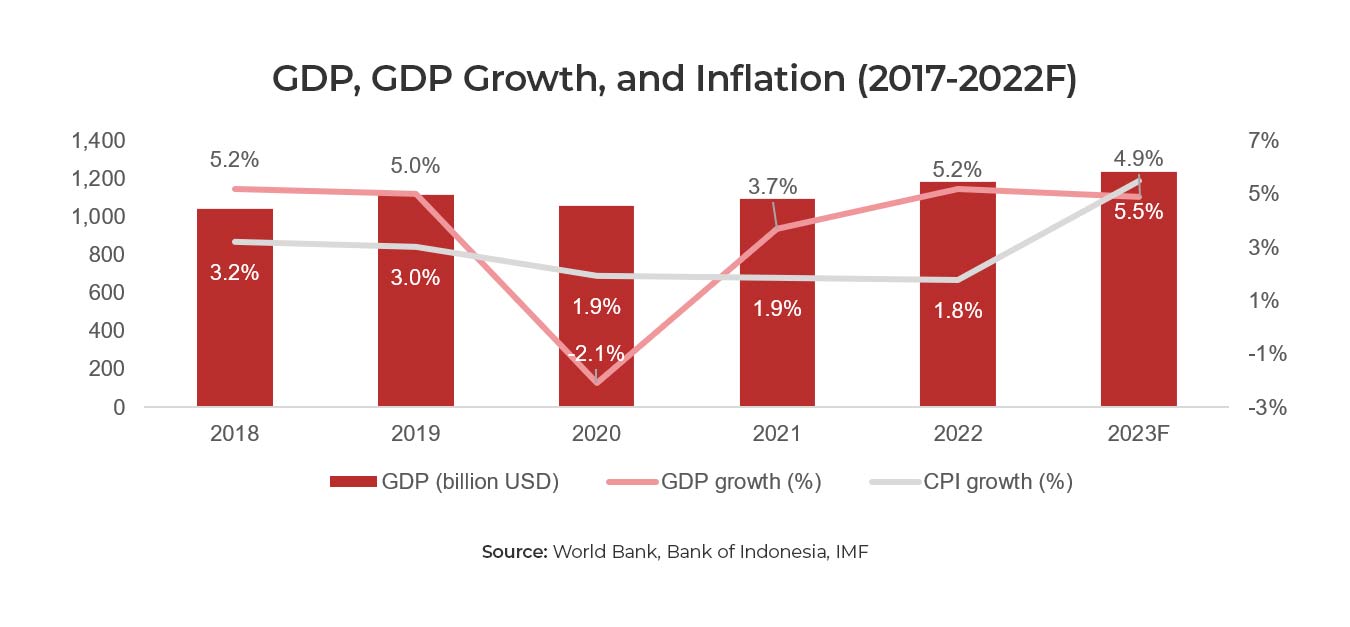

Indonesia’s economy has returned to its pre-Covid 19 levels as the GDP growth reached 5.2% in 2022. Several outstanding factors such as robust consumer spending and increased commodity exports helped contribute to the achievement. The easing of Covid-19 restrictions also helped businesses in Indonesia to return to operating in full capacity and previously delayed investments have resumed accordingly. As the main driver of the economy, private consumption has accelerated as well. Meanwhile, the trend of positive trade balance has continued further in 2022 as the country amassed a US$ 3.89 billions trade surplus by the end of December 2022. Negative trade balances have historically hindered the country’s economic growth, but since 2021, the export of nickel-derivative products, crude palm oil (CPO), iron and steel, and the non-oil and gas sector has increased by more than 35% respectively.

The economy is expected to continue in a positive manner in 2023 as the government is targeting the growth to reach between 4.5% – 5.3%. The World Bank forecasted Indonesia’s GDP to grow by an average of 4.9% for 2023-2025. Nevertheless, several concerns and uncertainties remain, driven by slow global growth, high inflation, global financial volatility, as well as potential risks related to global trade and supply chains.

Inflation

The Consumer Price Index (CPI) of Indonesia reached 5.51% in 2022, the highest rate since 2018. The highest inflation occurred in September as it increased by 1.26% due to the government’s decision to increase fuel prices. The price pressures have also been determined by rising international commodity prices, increased domestic energy tariffs, and higher production prices.

Looking forward, the Bank of Indonesia has projected that the inflation rate of 2023 will reach between 3-4%. The IMF projected that the CPI of Indonesia would reach 5.5% in 2023. The Bank of Indonesia’s monetary policy in 2023 will focus on stabilizing the Rupiah exchange rate and controlling inflation as part of mitigation measures against the propagating impact of global turmoil. The goal is to resume to the target of 2-4%.

Foreign direct investment (FDI)

In 2022, Indonesia’s FDI realization recorded a 44.2% increase (YoY), from US$ 31.1 billion in 2021 to US$ 44.8 billion 2022. The investment growth is one of the largest investment growth in Indonesia’s history. Even though the economy was halted by the pandemic in 2020 and 2021, the country has still managed to see a positive growth on investments and investment realizations in 2022, which were higher than the 6% target that the President originally set. In 2022, many investors were able to resume their investment activities after an initial suspension caused by strict lockdowns and travel restrictions. The recovery was further supported by the Ministry of Investment’s involvement in alleviating those investment-related problems.

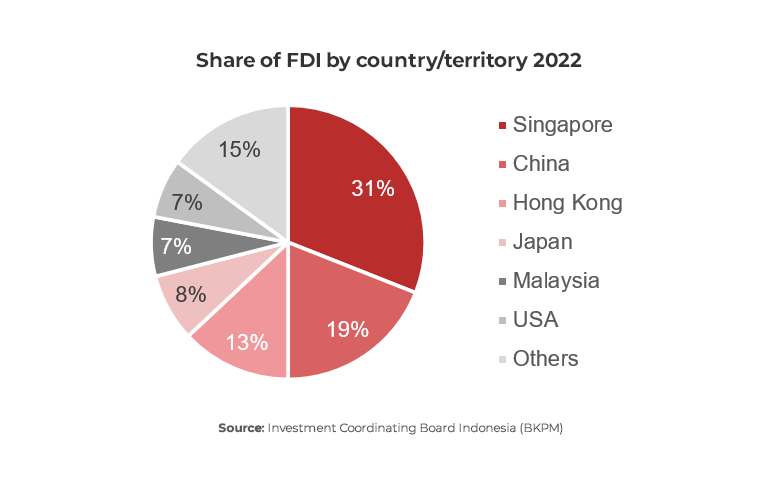

Singapore remained Indonesia’s largest foreign investor with an investment value of US$ 13.3 billion, making up around 31% of Indonesia’s total FDI in 2022. China became the 2nd largest investment partner, which pushed Hong Kong down to third position. For the first time in history, Malaysia joined the top five largest investment partners in Indonesia, with a total investment value of US$ 3.3 billion.

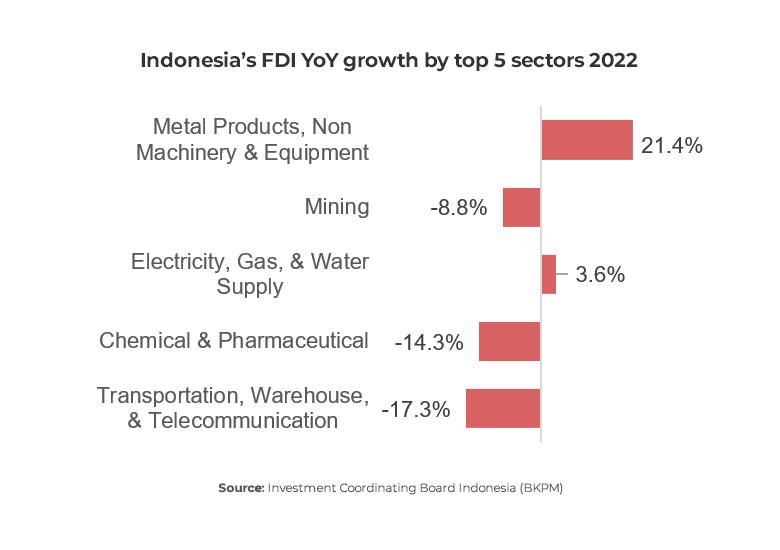

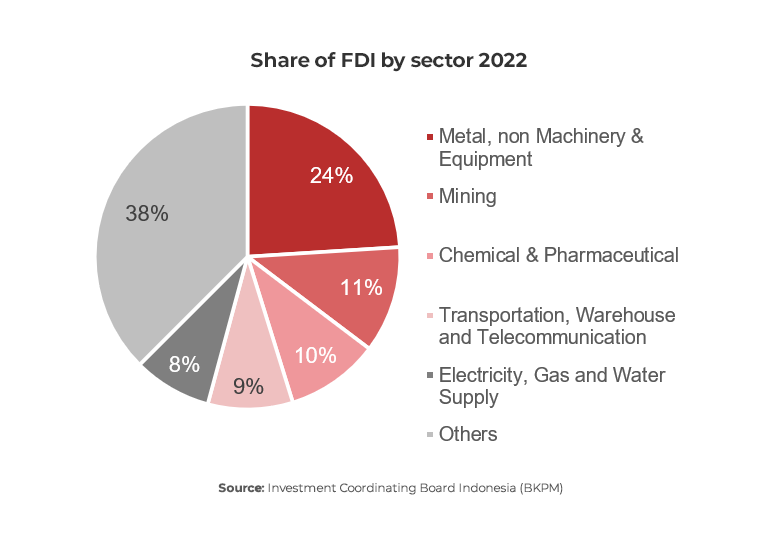

Metal, mining, transportation, property, and telecommunication are the sectors that received the most FDI in 2022. The metal industry experienced a growth of 21.4% compared to 2021. Although the above-mentioned industries were considered favorable industries for FDI, the annual growth wasn’t as significant. The mining industry experienced a decline of 8.78% in comparison to the performance in 2021. On the other hand, industries such as wood, forestry, textile, food crops, and paper and printing experienced the most significant growth in 2022

The contribution of FDI to total investment reached 54.2% with a YoY growth of 44.2%. Following the trend since 2020, more than half of FDI (52.7%) went into areas outside of the Java island with a growth of 35.9%. Central Sulawesi and North Maluku became the top 5 most targeted investment destination as the inflow of FDI to these areas reached 16.4% and 9.8% respectively.

Accelerating the development

of renewable energy

in Indonesia

As mentioned in the investment report 2022, the green economy has been considered one of the Indonesian government’s main focal points for investment initiatives. Cross-border cooperation is considered key in helping Indonesia realize its transition, and the government is striving to achieve this objective through the release of Presidential Regulation No. 112/2022.

The advancement of the electric vehicle (EV) industry in Indonesia can be traced back to the release of the Presidential Decree No. 55 in 2019. The government’s success in bringing several major manufacturers in the EV supply chain has encouraged and attracted investments of at least US$ 15 billion during 2019-2022. This investment is projected to contribute to establishing 140 gigawatt hours (GWh) in annual EV battery capacity in the country. The increasing domestic production of EVs is further expected to boost Indonesia’s GDP growth, contributing to manufacturing activity, exports and domestic vehicle sales.

However, EV is not the government’s only focus when enhancing the investment for green energy The state-owned utility enterprise, Perusahaan Listrik Negara (PLN), also released its latest Business Plan for Electricity Supply 2021-2030 which aims to achieve carbon neutrality by 2060. The company is striving to increase renewable energy’s contribution to the total energy mix to 25% by 2025. Through the same business plan, they are also aiming to increase the percentage of renewable energy by more than 50% in new power plants. This commitment was further supported by the Presidential Regulation No. 112/2022. The regulation aims to help increase investments, accelerate the process in achieving the renewable energy mix targets and reducing greenhouse gas emissions.

Since 2005, several fiscal incentives aimed at boosting investments have already been put in place. Some of the incentives include tax holidays (the exemption or reduction of corporate tax income for a certain period of time), tax allowance (a tax relief in the form of a deduction against business income tax), and import facilitation (an exemption from import duty, value added tax, and income tax). Additionally, the government is also preparing a roadmap for terminating the use of coal-fired power plants as well as introducing a funding and financing framework aimed at accelerating the energy transition. Those above-mentioned factors are expected to help increase investments in green energy further, although the applicable feed-in tariff for renewable energy would require some improvements to increase its attractiveness.

The government’s targeted efforts in improving the investment environment in the country’s green energy sectors creates new favorable opportunities for foreign investors looking to tap into the market. The inevitable growth of the market is expected to attract attention from both strategic and private investors and create many possibilities for dealmaking.

Export ban on nickel, bauxite and copper aims to boost Indonesia’s downstream industry

The export ban on nickel ore has helped develop the downstream industry of nickel-smelters in Indonesia since its introduction 2020. As most of smelters are located in the eastern part, a significant increase in investments to that area has been recorded. Historically, the western part of Indonesia has been the main recipient of FDI. The investments have also increased the export value of nickel derivative products in the last two years. The success has motivated the government to also introduce an export ban on bauxite and copper starting June 2023.

In accordance with The National Industrial Development Master Plan 2015-2035, the government has planned to develop its nation’s industry to be stronger and more sustainable. Several key strategies have been introduced to succeed, including committing to developing a green economy, digitalizing micro, small and medium enterprises (MSMEs), and developing downstream industries. Regarding the latter, Indonesia’s downstream policy strategy is focusing on the eight priority sectors mineral, coal, oil, gas, agriculture, maritime, fishery and forestry. It is believed that those strategies will be essential in building a world class manufacturing industry.

The above-mentioned policy drove the country’s export ban on nickel ore in 2020, with the intention to encourage development in Indonesia’s downstream industry of nickel-derivative products. The ban is continuing to elevate investments into the nickel smelter industry and the number of nickel smelters are expected to rise from 13 smelters in 2022, to 54 smelters by 2024.

Based on the data from the Central Bureau of Statistic in September 2022, the export value of nickel derivative commodities increased significantly since the government imposed the ban. The export value of nickel derivative commodities in January-August 2022 reached US$ 12.35 billion, or grew by 263% compared to 2019. Prior to the imposition of the ban, the export value only reached US$ 3.40 billion. With more smelters’ constructions completing soon, it’s believed that the export value will reach even higher values.

With the success of building the downstream industry for nickel, similar measures will now be implemented to other minerals as well, such as bauxite and copper, starting June 2023. Indonesia’s bauxite reserves are approximately 4% of total global reserves (30.3 billion tons). The size of these reserves makes Indonesia the sixth largest bauxite reserve country in the world, and it’s projected that the investment value of the bauxite processing industry will reach US$ 24.2 billion in 2027.

For copper, Indonesia has the seventh largest reserves in the world with 28 million tons, or 3% of the world’s total reserves. At present, there are three smelters (Freeport, Kalimantan Surya Kencana, and Amman Mineral) under construction. Once completed, they will be able to supply copper cathode with a total of 1.1 million ton/year.

However, it is possible that the export ban on bauxite and copper won’t have the same effect as it did for nickel ore. Unlike nickel, many other countries possess larger reserves and production capacities than Indonesia does, which might be able to cater the global demand.

Nevertheless, the potential business feasibility of existing nickel smelters in Indonesia can serve as a baseline for investing in the country. The government is implementing incentives to facilitate for foreign investors interested in investing in Indonesia’s downstream industry. Currently, efficiency and cost in managing necessary permits, transparency, and expeditiousness are the main focal points. For regions outside the Java Island, the government provides additional incentives and services to further encourage the local development.

About this report

This report was compiled with contributions from the team of business experts in our Indonesia office.

ARC Consulting, a division of ARC Group, is an advisory firm specialised in supporting western companies operating in Asia. We are on a mission is to bridge between the business ecosystems of Asia and those in Europe and the US. Our services cover market entry and expansion, production and sourcing, cross-border M&A as well as operational improvement and compliance.

If you are interested in exploring how we can support your business in Indonesia, reach out through our contact page, or leave your email below for a representative to contact you directly: